Policy Solution

Catastrophe (CAT) bond

Funding and Financing

Case Studies

Summary

Funds are paid to an insurer when a pre-determined index is triggered like an extreme weather event. Proceeds from the CAT bond are put in a collateral account and only released if the trigger event occurs. If a payment is triggered, typically interest and principal repayment obligation are deferred or forgiven.

Implementation

Use CAT bonds to provide long-term financial protection against climate-related risk. One example is a Resilience Bond, which links catastrophe insurance to infrastructure investments using insurance savings as revenue to fund resilient infrastructure projects.

Considerations for Use

CAT bonds can include interest or repayment discounts to governments that invest in risk-mitigation infrastructure.

Overview

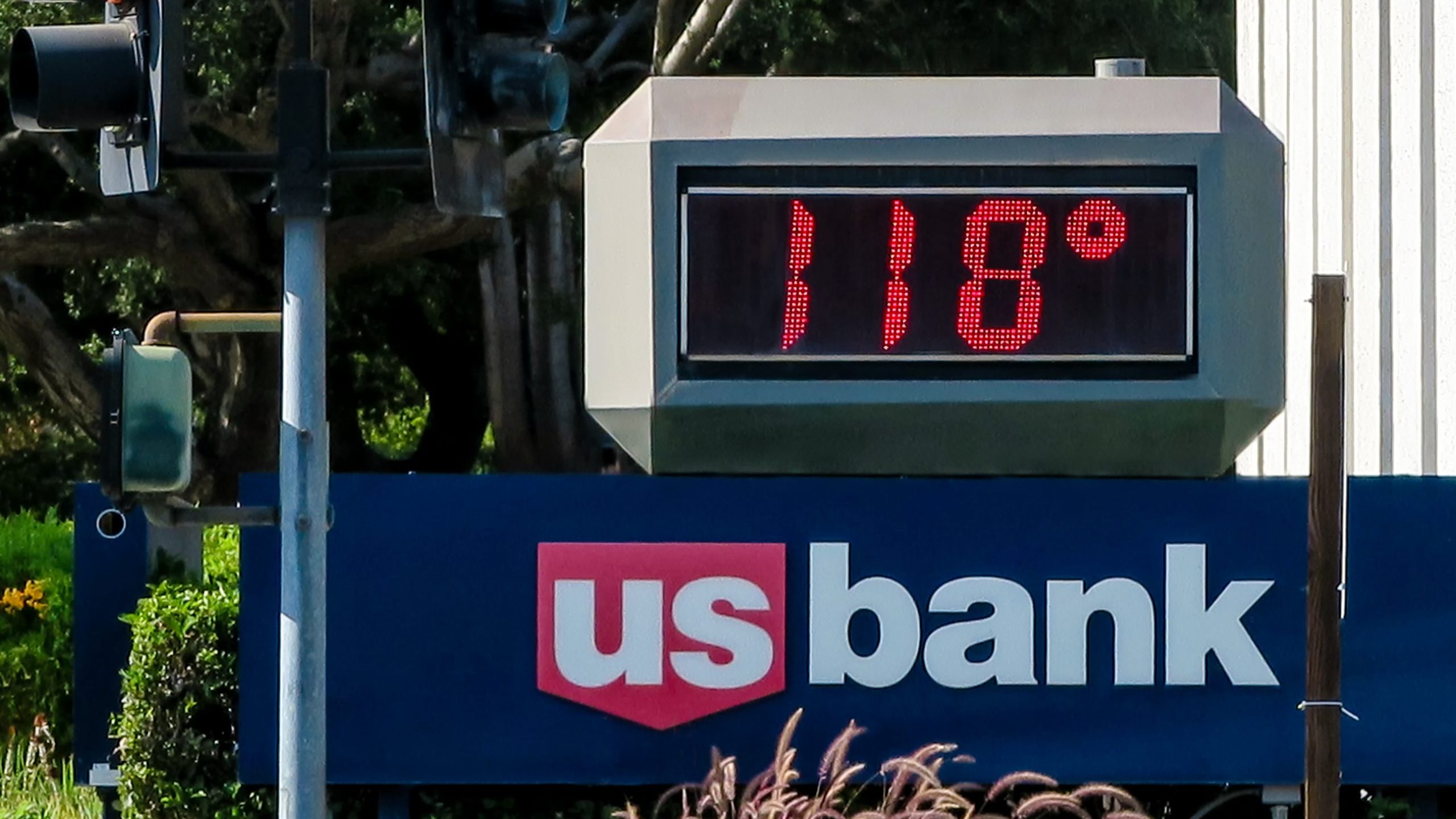

Climate:

Cold, Hot/Dry, Hot/Humid, TemperatePolicy Levers:

Funding and FinancingThe allocation of public or philanthropic funding or private financing to implement projects, including risk transfer mechanisms.Trigger Points:

Preparatory measures (actions to establish authority to act)Actions to establish/ensure the authority to act when appropriate trigger-points occur.Intervention Types:

Planning/PolicySectors:

Disaster Risk Management

Case Studies

Impact

Target Beneficiaries:

Business owners, Property owners, Renters, ResidentsPhase of Impact:

Risk reduction and mitigationMetrics:

Proceed amount and allocation

Implementation

Intervention Scale:

Region, State/ProvinceAuthority and Governance:

National government, State/provincial governmentImplementation Timeline:

Short-term (1-2 Years)Implementation Stakeholders:

City government, Industry, National government, State/provincial governmentFunding Sources:

Private investment, Public investmentCapacity to Act:

HighBenefits

Cost-Benefit:

MediumPublic Good:

LowGHG Reduction:

N/ACo-benefits (Climate/Environmental):

N/ACo-benefits (Social/Economic):

Increase property values, Reduce poverty